What is Goods and Service Tax (GST)?

GST is known as the Goods and Services Tax. It is an indirect tax which has replaced many indirect taxes in India such as the excise duty, VAT, services tax, etc. The Goods and Service Tax Act was passed in the Parliament on 29th March 2017 and came into effect on 1st July 2017.

In other words, Goods and Service Tax (GST) is levied on the supply of goods and services. Goods and Services Tax Law in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. GST is a single domestic indirect tax law for the entire country.

Generally, we have seen that in Invoices supplier charges either CGST + SGST or only IGST. Why is it so? This is because, GST is the consumption-based tax, means charge of CGST + SGST or IGST depends on where particular goods or services are actually consumed. In case of Goods, it’s easy to identify where goods are consumed being tangible in nature, but in case of services it’s difficult to identify where services are actually consumed, especially in case of services provided over the internet. The very purpose of this article is to clearly understand such difficulty in detail.

Introduction of OIDAR services

The Central Board of Indirect Taxes and Customs (CBIC) has formed a separate category to capture the services provided and received over the internet (without a physical interface between the supplier and the recipient). Sale of digital content like movies, TV shows, music, etc., is an example here.

The Government recognised the need for a separate category for Online Information Database Access and Retrieval (OIDAR) services. These services could be supplied remotely without the supplier having a physical location or presence in India. This needed attention as the remote working format could provide an unfair advantage to service providers located outside India at the cost of Indian service providers providing similar services.

With an intention to widen the tax net and to introduce a level playing field to market participants, the CBIC has introduced specific rules for OIDAR service providers. This article will further discuss the OIDAR services and the Place of Supply for such services.

Applicability of GST for WebHosting Companies or for Services Provided through the Medium of Internet

Why Different Treatment from Other Services?

Online Information Database Access and Retrieval Services (OIDAR) has grown tremendously in India as more users are buying and selling items online, thanks to smartphones and internet connectivity. Under earlier tax laws, there was no clear treatment of online sales. GST has proper rules in place for Online Information Database Access and Retrieval Services portals like Hotstar, Netflix, Amazon and its sellers.

- OIDAR Services can be provided online from remote location outside the taxable territory.

- Similar service provided by an Indian service provider to recipients in India would be taxable.

- Further, such services received by a registered entity (means registered under GST) in India from person outside India would also be taxable under reverse charge (i.e., GST need pay by the recipient).

- The overseas suppliers of such services would have an unfair tax advantage should the services provided by them be left out of the tax net.

- At the same time, since the service provider is located overseas and may not be having a presence in India, the compliance verification mechanism become difficult.

- It is in such circumstances, that the government has plans to come out with a simplified scheme of registration for such service providers located outside.

On Which Supply GST is Applicable?

Firstly, we understand definition of supply under GST in simplified manner i.e., on particular supply GST is applicable or not. Supply means supply of Goods or Services or both.

- All forms of supply of Goods or Services by person for a consideration for the purpose of business

- Import of services for a consideration even if it is for personal purpose (e.g., fees for Interior designer hired for the designing of house which is located in India).

What is OIDAR Services?

Online Information Database Access and Retrieval services (hereinafter referred to as OIDAR) is a category of services provided through the medium of internet and received by the recipient online without having any physical interface with the supplier of such services.

Definition of OIDAR Services

OIDAR to mean services whose delivery is mediated by information technology over the internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention and impossible to ensure in the absence of information technology and includes electronic services Such as,

- Advertising on the internet;

- Providing cloud services, web hosting services;

- Provision of e-books, movie, music, software and other intangibles through telecommunication networks or internet;

- Providing data or information, retrievable or otherwise, to any person in electronic form through a computer network;

- Online supplies of digital content (movies, television shows, music and the like);

- Digital data storage; and

- Online gaming;

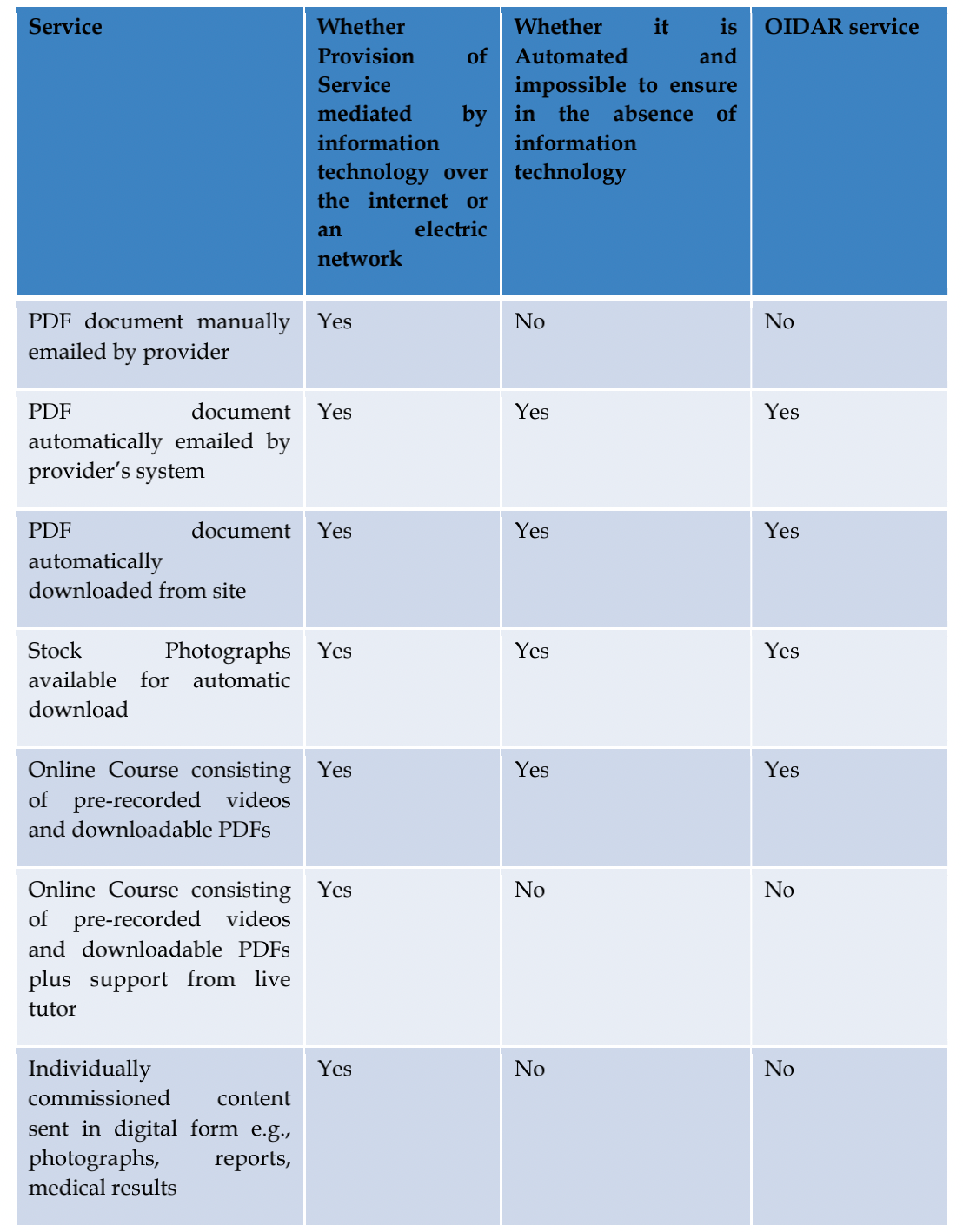

How to Determine Whether a Particular service is an OIDAR Service?

To determine whether a particular service is an OIDAR service, the following tests need to be applied:

- (A) Services whose delivery is mediated by information technology over the internet/electronic network

AND

- (B) Services are automated and impossible to ensure in the absence of information technology.

Examples of OIDAR Services

Website Supply, Web-Hosting, Distance Maintenance of Programmes and Equipment

- Website hosting and webpage hosting

- Automated, online and distance maintenance of programmes

- Remote systems administration

- Online data warehousing where specific data is stored and retrieved electronically

- Online supply of on-demand disc space

Supply of Software and Updating thereof:

- Accessing or downloading software (including procurement/ accountancy programmes and anti-virus software) plus updates

- Software to block banner adverts, otherwise known as Banner blockers

- Download drivers, such as software that interfaces computers with peripheral equipment (such as printers)

- Online automated installation of filters on websites

- Online automated installation of firewalls

Supply of images, text and information and making available of databases:

- Accessing or downloading desktop themes

- Accessing or downloading photographic or pictorial images or screensavers

- The digitised content of books and other electronic publications

- Subscription to online newspapers and journals

- Weblogs and website statistics

- Online news, traffic information and weather reports

- Online information generated automatically by software from specific data input by the customer, such as legal and financial data, (in particular, data such as continually updated stock market data, in real time)

- The provision of advertising space including banner ads on a website/web page

- Use of search engines and Internet directories

Supply of music, films and games, including games of chance and gambling games, and of political, cultural, artistic, sporting, scientific and entertainment. broadcasts and events:

- Accessing or downloading of music on to computers and mobile phones

- Accessing or downloading of jingles, excerpts, ringtones, or other sounds

- Accessing or downloading of films

- Downloading of games on to computers and mobile phones

- Accessing automated online games which are dependent on the Internet, or other similar electronic networks, where players are geographically remote from one another.

Supply of Distance Teaching (Includes Virtual Classrooms):

- Automated distance teaching dependent on the Internet or similar electronic network to function and the supply of which requires limited or no human intervention. These include virtual classrooms, except where the Internet or similar electronic network is used as a tool simply for communication between the teacher and student.

- Workbooks completed by pupils online and marked automatically, without human intervention

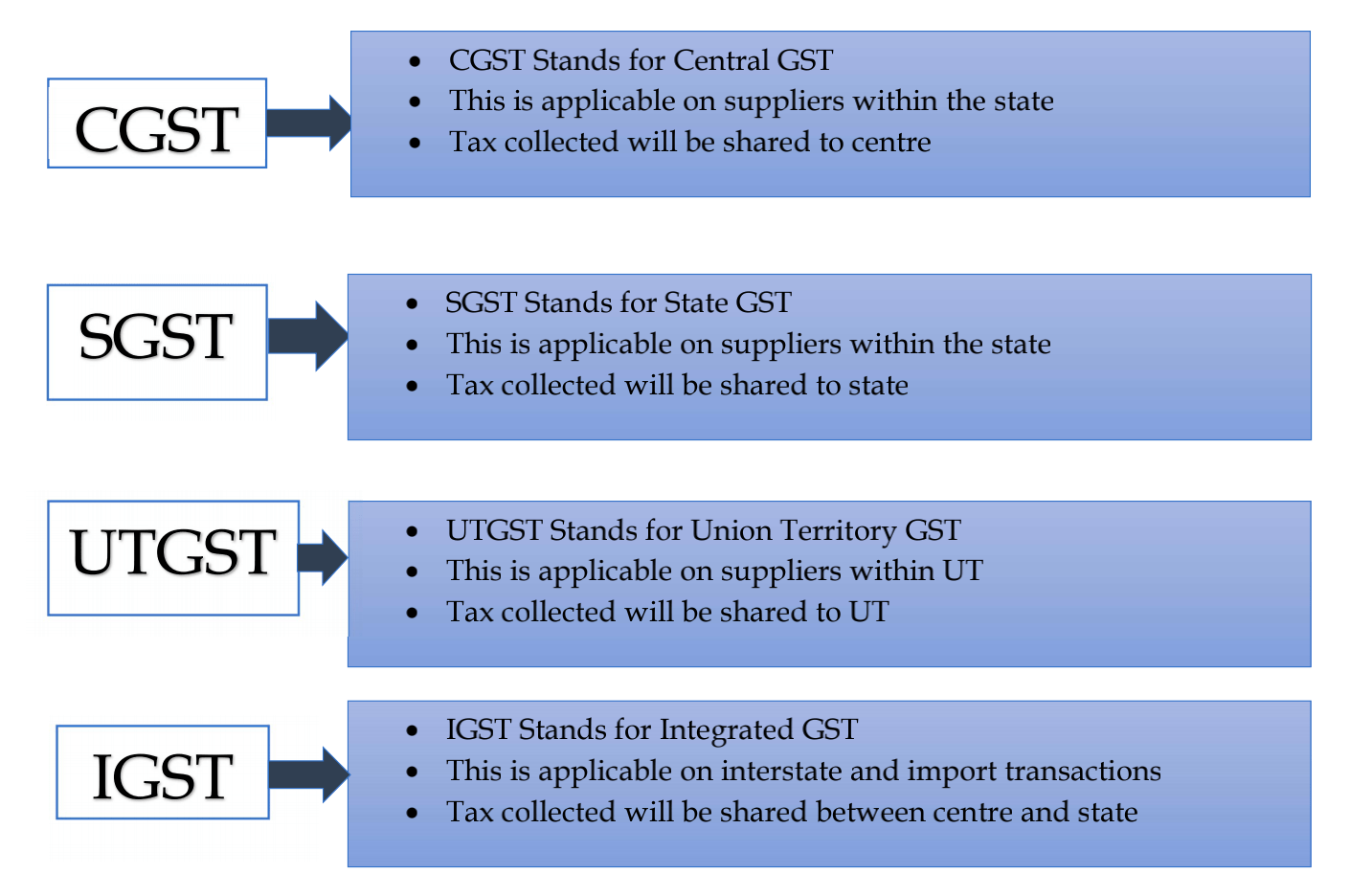

GST Structure:

How Would OIDAR services be taxable under GST?

Now we know which supply is covered under GST and which is not. GST is consumption tax. In other words, the GST is applicable on Goods or services where it is consumed. So, for that it is very important to know that particular transaction is Interstate supply or Intrastate supply. Because which tax (i.e., CGST and SGST/UT or IGST) is to be levied will depend on whether particular transaction is as Intrastate Supply or Interstate supply.

To determine whether transaction is an interstate or intrastate and which tax is to be levied will depend on whether particular transaction is an interstate supply or intrastate supply, we have to understand concept of Place of Supply.

Why we need to understand concept of Place of Supply?

As Goods are tangible, the determination of their place of supply is not difficult. Generally, the place of delivery of goods becomes the place of supply.

However, services being intangible in nature, it is not easy to determine exact place where services are supplied due to following factors:

- Alteration in the manner of delivery of service.

- Service provider, Service receiver and the service provided may not be ascertainable.

- For supplying a service, a fixed location of service provider is not mandatory.

Intrastate Supply means – Location of Supplier and Place of Supply are in same states/union territories.

Intrastate Supply means –

- Location of Supplier and Place of Supply are in:

- A. Two different states/ union territories;

- B. State and Union territories,

- Import of Goods or Services

- Supply of Goods where supplier located in India and the place of supply outside India (E.g., A Ltd in Maharashtra receives an order from B Ltd in London to deliver Goods at C Ltd in Maharashtra)

- Supply of Goods and Services to/by SEZ developers/units

- Supplies made to a tourist

Followings are the various elements involved in a service transaction can be used as proxies to determine the place of supply:

-

- Location of service supplier;

- Location of service provider;

- Place where the activity takes place;

- Place where the service is consumed; and

- Place/person to which/whom actual benefit flows;

Now What is Place of Supply for OIDAR?

There are three scenarios:

- If Location of Supplier and Location of recipient is in India

- If Location of Supplier is in India and Location of recipient is outside India

- If Location of Supplier outside India and Location of recipient is in India

(1) If Location of Supplier and Location of recipient is in India

If location of supplier and location of recipient is in India then place of supply will be “Location of the recipient”.

Example 1 – Location of Supplier is in Maharashtra and Location of Recipient is also in Maharashtra then place of Supply will be Location of Recipient i.e., Maharashtra and the supply will be Intrastate supply therefore CGST and SGST will be charged.

Example 2 – Location of Supplier is in Maharashtra and Location of Recipient is Gujarat then place of Supply will be Location of Recipient i.e., Gujarat and the supply will be Interstate supply therefore IGST needs to charge

(2) If the Location of Supplier is in India and Location of recipient is outside India

If Location of Supplier is in India and Location of recipient is out of India then also place of supply will be “Location of the recipient”. Generally, this is type of transaction called as an Export of Services but for the purpose of GST meaning of Export of services is different.

According to GST Law Export of Services means:

- The supplier of service is located in India;

- The recipient of service is located outside India;

- The place of supply of service is outside India;

- The payment for such service has been received by the supplier of service in convertible foreign exchange; and

- The supplier of service and the recipient of service are not merely establishment of a distinct person.

Whenever Location of supplier is in India and Place of Supply is outside India then such transaction is deemed to be in the course of Inter-state trade or commerce i.e., IGST needs to charge.

Export of Services will be treated as ‘zero rated Supplies’ i.e., no tax would be payable on such supplies if services supply under Letter of Undertaking (LUT).

A person making export of service shall be eligible to claim refund under either of the following options:

(a) He may supply goods or services under Letter of Undertaking (LUT) without payment of IGST and can claim refund of ITC.

OR

(b) He may supply goods or services on payment of IGST and claim refund of such tax paid on such supply.

(3) Location of Supplier is outside India and Location of recipient is in India

(i) Where the supplier of service is located outside India and the recipient is located in India. In such cases also the place of supply would be India if following conditions are satisfied:

- Location of address presented by the recipient is in taxable territory;

- The credit card or debit card or store value card by which the recipient of services settles payment has been issued in the taxable territory;

- The billing address of the recipient of services is in the taxable territory;

- The internet protocol address of the device used by the recipient of services is in the

- taxable territory;

- The bank of recipient of services in which the account used for payment is maintained is in the taxable territory;

- The country code of the subscriber identity module card used by the recipient of services is of taxable territory;

- The location of the fixed land line through which the service is received by the recipient is in the taxable territory;

(ii) Charge of GST

- Generally, amount of GST is collected and paid by supplier of goods or services but in this situation, supplier is located out of India therefore for this transaction there are two scenarios: where the supplier of such service is located outside India and the recipient is a business entity (registered person) located in India, the reverse charge mechanism would get triggered and the recipient in India who is a registered entity under GST will be liable to pay IGST (as intrastate supply) under reverse charge and undertake necessary compliances. This is called Import of services.

- If the supplier is located outside India and the recipient in India is an individual consumer and receiving OIDAR services for the purpose of other than business or profession in India. In such cases also the place of supply would be India and the transaction is amenable to levy of GST, but the problem would be, how such tax would be collected. It would be impractical to ask the individual in India to register and undertake the necessary compliances under GST for a one-off purchase on the internet.

- For such cases the supplier of services located in a non-taxable territory shall be the person liable for paying integrated tax on such supply of services.

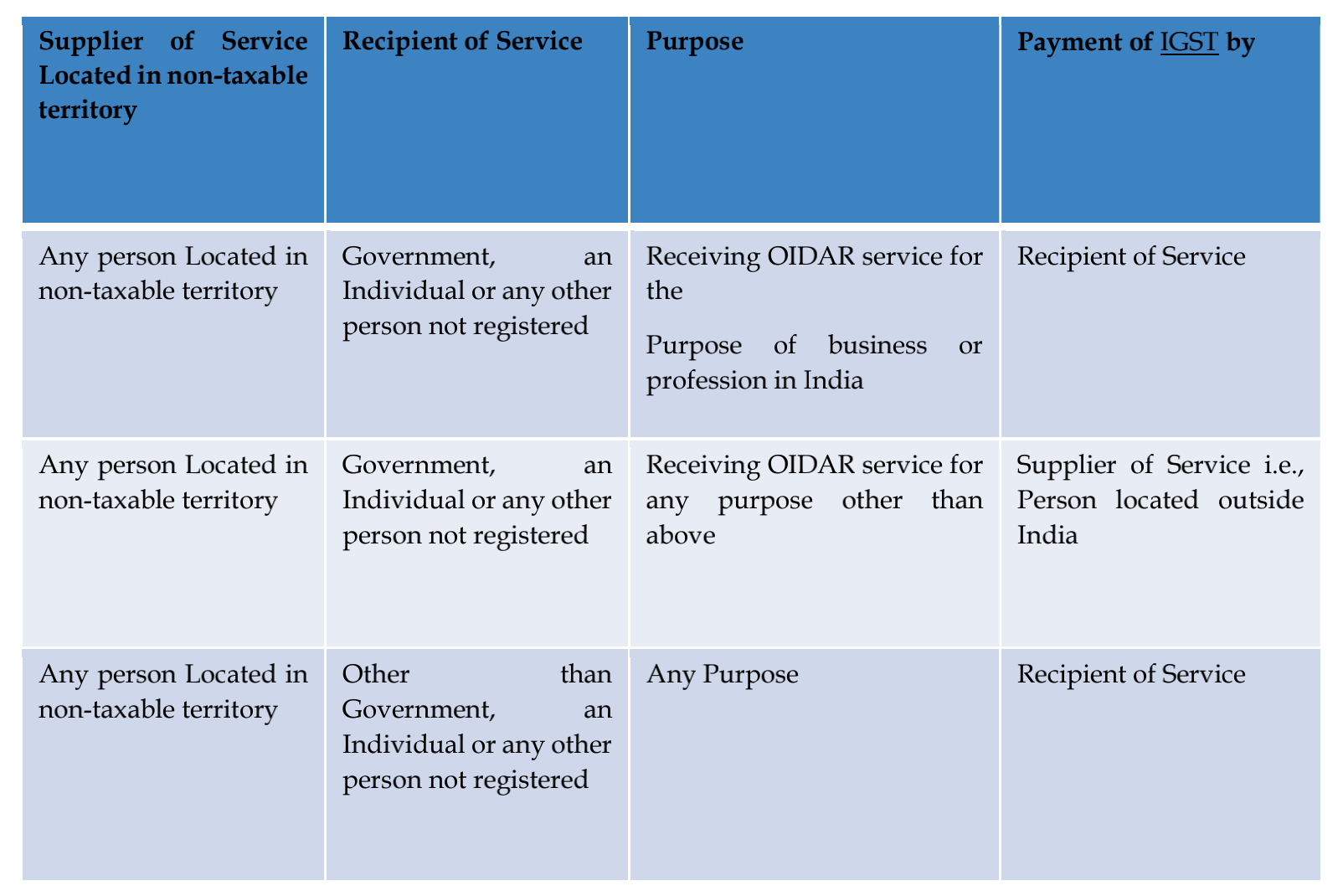

Summary for Payment of GST

General: Amount of GST is collected and Paid by Supplier of Goods or Services.

Special Case: However, if Supplier of OIDAR service is Located outside India and recipient of service and Place of service is in India then:

(iii) Payment of GST in case of Supplier is located in non-taxable territory When liability to pay tax is of such Supplier:

- Representative of Supplier in taxable territory liable to pay tax

- If such supplier does not have a physical presence of does not have a representative for any purpose in the taxable territory, he may appoint a person in taxable territory for the purpose of paying IGST.

(iv) Who is liable to take Registration?

Persons providing services need to register if their aggregate turnover exceeds Rs.20 lakh (for normal category states) and Rs.10 lakh (for special category states).

However, in following cases registration is compulsory irrespective of their aggregate turnover:

- Making inter-state taxable supply of GOODS (NOT SERVICES);

- E-commerce who required to pay tax;

- E-commerce who provide platform to the supplier to supply through it;

- Person supplying OIDAR services from place outside India to person in India;

- Suppliers of goods supplying through an e-commerce platform;

- An e-commerce company must register itself in GST in every state where it supplies goods or services

(v) Registration and Returns for any person supplying OIDAR services from a place outside India to a non-taxable recipient

Registration:

E – application in FORM GST REG-10 by person supplying OIDAR services from a place outside India.

Returns:

Every such supplier shall file return in FORM GSTR-5A on or before the 20th day of Succeeding month.

(vi) Frequently Asked Questions

A) Are all the OIDAR service providers required to file GSTR 5A?

==> No, only the OIDAR service providers who are non-resident and are providing services to unregistered persons or government are required to file GSTR 5A.

B) Is registration necessary for these non-resident OIDAR service providers?

==> Yes, as without the registration, they will not have a GSTIN and without a GSTIN, the filing of GSTR 5A is not possible.

C) Can Input tax credit be availed in Form GSTR 5A?

==> No, there is no provision to avail the input tax credit in GSTR 5A. As it is also evident from the format above where there is no field or table to enter the details of ITC available.

D) How can the service providers make use of Authorised representatives in India to file returns?

==> The authorized representatives of the non- resident OIDAR service providers can act as their agent and file GSTR 5A on their behalf. They can also assist in making the payment of the taxes due.

Disclaimer: The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.